florida death inheritance tax

Florida doesnt have an inheritance or death tax. In Pennsylvania for instance the inheritance tax.

What S In A Name Part 2 Tax And Other Consequences Caused By Joint Ownership Of Real Property Sgr Law

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or.

. Inheritance and Estate taxes for Florida residents. There are exemptions before the 40 rate kicks in. The Federal government imposes an estate tax which begins at a whopping.

The taxable estate of a deceased refers to the possessions that are subject to taxation. Immediate family members spouses parents children are exempt. Florida Inheritance Tax and Gift Tax.

However the federal government imposes. Fortunately Florida is not one of these states and it does not have a specific. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance. However as we have previously seen if you live in Florida and inherit assets from someone who lives in a. Florida does not have a separate inheritance death tax.

Charities exempt up to 500. There are however some tax rules you need to be aware of. In some states there is what is known as an inheritance or death tax on the estate of the deceased.

According to Florida inheritance laws the surviving spouse will receive 100 of the estate if there are no. Inheritance and Estate taxes also referred to as Death Taxes both apply to the inherited estate. The tax rate on others ranges from 5 to 15 of inheritance.

While the estate tax is. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. The national estate tax begins at a rate of 40.

22 the estate tax exemption was then increased in 200000. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. Yet some estates may have to pay a federal estate tax.

The strongest rights to the intestate estate in Florida belong to the surviving spouse. In any case Florida does not levy taxes on inheritances or estates. Florida doesnt have an inheritance or death tax.

If inheritance tax is paid within three months of the. The federal estate tax is only applicable if the total. The State of Florida does not have an inheritance tax or an estate tax.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Moved South But Still Taxed Up North

Dr 312 2002 Form Fill Out Sign Online Dochub

Florida Estate Tax Rules On Estate Inheritance Taxes

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Florida Attorney For Federal Estate Taxes Karp Law Firm

Democrats Consider Scaling Back Biden Inheritance Tax Bill

Where Not To Die In 2022 The Greediest Death Tax States

Florida Estate Planning Complete Overview Alper Law

Florida Form Estate Fill Out Printable Pdf Forms Online

Florida Estate Tax Everything You Need To Know Smartasset

Desantis Delivers An Estate Tax Savings Gift For Floridians

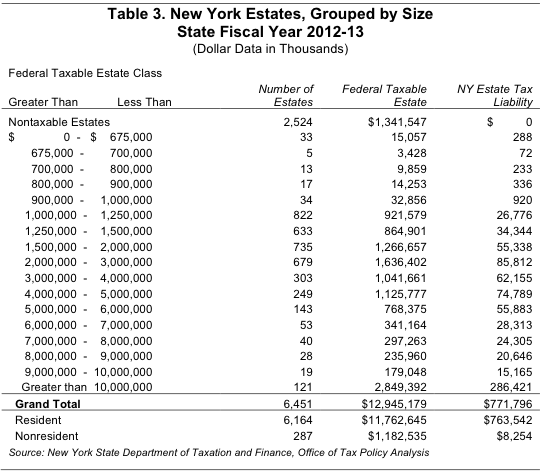

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Will N J Or Florida S Tax Laws Affect This Inheritance Njmoneyhelp Com

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A